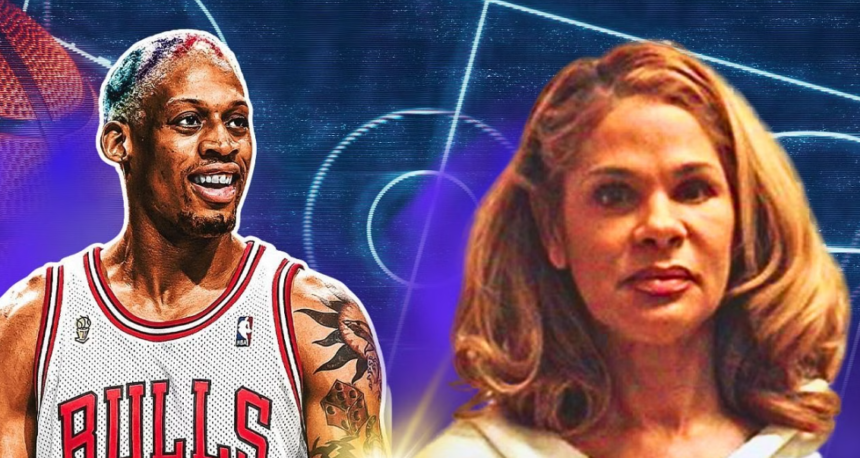

Peggy Fulford, a name synonymous with financial fraud, became infamous for her ability to deceive some of the most well-known athletes and celebrities in America. Her story is a cautionary tale of trust betrayed, wealth stolen, and lives altered forever. As a self-proclaimed financial advisor, Fulford promised to manage the wealth of her clients, ensuring their financial security. Instead, she embezzled millions of dollars, leaving a trail of financial ruin in her wake.

The Early Life of Peggy Fulford: A Path to Deception

Born Peggy Ann Barard, Fulford grew up in New Orleans, Louisiana. Her early life provided little indication of the financial devastation she would later cause. She was known for her charm, intelligence, and the ability to blend into high society. However, beneath this veneer of sophistication lay a deep-seated desire for wealth and power, which would eventually lead her down a path of criminality.

Fulford’s journey into the world of financial fraud began with the creation of various aliases, including Peggy King, Peggy Williams, and Peggy Simpson. These aliases allowed her to operate in different circles, avoiding detection and building a network of trust among her future victims. She claimed to hold degrees from prestigious universities and portrayed herself as an expert in finance, all of which were fabrications designed to bolster her credibility.

The Rise of Peggy Fulford: Manipulation and Control

Peggy Fulford‘s rise to prominence in the world of financial management was swift and calculated. She targeted high-profile athletes and celebrities, individuals with substantial wealth but often limited financial knowledge. Her victims included NFL players, NBA stars, and other successful professionals. She promised to handle their finances, including paying bills, managing investments, and ensuring their financial futures.

Fulford’s method of operation was simple yet effective. She ingratiated herself into the lives of her clients, becoming more than just a financial advisor. She acted as a confidante, a friend, and in some cases, almost like a family member. This deep level of trust allowed her to gain control over her clients’ finances without raising suspicion.

Once she had access to their bank accounts and financial information, Fulford began siphoning off funds for her personal use. She used the stolen money to fund a lavish lifestyle, purchasing luxury cars, real estate, and designer clothing. Her clients, unaware of the theft, continued to believe that their finances were being managed responsibly.

The Unraveling of the Fraud: How Peggy Fulford Was Exposed

Despite her efforts to maintain the facade of a successful financial advisor, cracks began to appear in Fulford’s operation. Some of her clients started noticing discrepancies in their financial statements. Bills were left unpaid, investments were not yielding returns, and large sums of money were missing from their accounts. Suspicion grew, leading some victims to hire independent auditors to review their finances.

The audits revealed the extent of Fulford’s deception. It became clear that she had been systematically draining her clients’ accounts for years. In some cases, she had stolen millions of dollars, leaving her victims in financial ruin. The revelation of her crimes shocked not only her clients but also the public, as the scale of her fraud became apparent.

Legal Repercussions: The Downfall of Peggy Fulford

In 2016, Peggy Fulford was arrested and charged with multiple counts of fraud and embezzlement. The case against her was overwhelming, with evidence of her fraudulent activities meticulously documented. During the trial, Fulford’s victims testified about the impact of her crimes, describing how they had trusted her with their life savings, only to be left with nothing.

Fulford attempted to defend herself by claiming that the funds were used for legitimate investments, but the evidence told a different story. The prosecution presented a clear picture of a woman driven by greed, who had exploited her clients for personal gain. In 2018, she was sentenced to 10 years in federal prison, a punishment that many of her victims felt was too lenient given the extent of her crimes.

The Aftermath: Lessons Learned from the Peggy Fulford Case

The case of Peggy Fulford serves as a stark reminder of the importance of vigilance in financial matters. Even the most successful individuals can fall victim to fraud if they place too much trust in the wrong person. Fulford’s victims, many of whom were left financially devastated, have since spoken out about the need for better education and awareness regarding financial management.

One of the key lessons from this case is the importance of conducting thorough due diligence when choosing a financial advisor. Verifying credentials, checking references, and seeking second opinions can all help prevent such a tragedy from occurring. Additionally, it’s crucial for individuals to stay actively involved in their financial affairs, rather than relinquishing complete control to an advisor.

Conclusion

Peggy Fulford’s story is one of deception, betrayal, and the devastating consequences of financial fraud. Her actions not only destroyed the lives of her victims but also served as a wake-up call for others in similar situations. While Fulford may be behind bars, the impact of her crimes continues to be felt by those she wronged.

As we reflect on this case, it is clear that financial fraud can happen to anyone, regardless of their wealth or status. By staying informed, vigilant, and involved in our financial matters, we can protect ourselves from becoming the next victim of a Peggy Fulford.